[/text_block]

4Advisors was created to educate other advisors on fiduciary standards that in-return prospects independence and freedom from larger corporations. We accomplish this by:

PROMOTING ENGAGEMENT

For advisors that little experience or want to take the next step into their career, we want our community to mentor, support, and educate anyone seeking guidance.

FOSTERING SUCCESS

We stick by the motto “advisors serving clients, not corporations” for a reason. Bureaucracy and large corporations continue to expand and hinder growth of small companies that want to do diligence for our nation. Our goal at 4Advisors is to be an ongoing source of information and advocacy for advisors that want to make a difference.[/text_block]

BETWEEN 2005 AND 2015, 87,000 FINANCIAL ADVISORS HAVE BEEN DISCIPLINED FOR MISCONDUCT OR FRAUD.

Misbehaving financial advisors don’t just go away once they’re disciplined. According to the study, about half of misbehaving advisors get to keep their job, – and become repeat offenders. According to a 2010 study, 56% of American households had consulted financial professionals for advice – having an independent advisor is more relevant than ever before.[/text_block]

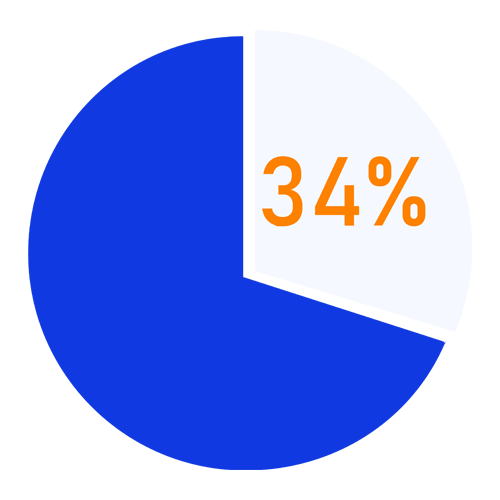

34% OF U.S. ADULTS HAVE ZERO NON-RETIREMENT SAVINGS.

And over 37% of workers expect to retire after age 65.